Meet the Super Consumers

In 2021, Powered by Nine introduced you to the Blindspot in Australian marketing - a high value audience who were under valued and under represented, but worth $2.3 billion in weekly household spend. That blindspot is Australians aged 55-64.

Earlier this year, we partnered with GFK to undertake a new study, taking a deeper dive into the behaviours and impact of the Super Consumer.

Source: ID Consulting, census 2021

Recap on the event

What you need to know

01

Australia's population is ageing

From 2016 to 2021* Australia’s population has increased by 2.02 million, with 13% of that growth coming from people aged 55-64.

Overall, the median age has increased from 35 to 38 over the past 20 years.

While people aged 25-44 represent the largest age cohort in terms of population (28%), the 45-64 year groups equate to 25%, of which around half are over 55.

Source: ID Consulting, census 2021

Rethinking retirement

The retirement age is the oldest it has been since the early 1970s.

Shift in retirement age since early 2000s:

Men

63.2 > 66.2

Women

61.7 > 64.8

Source: KPMG, Feb 2023. ‘When will I retire?’ Educated Aussies are choosing to work longer. [1] ABS, RBA Mar 2020 'Demographic Trends, Household Finances and Spending'

Highest household income

45-54s record the highest household income and household consumption whilst 55-64s are on par with 35-44s, and increasing at the fastest rate.

Households headed by 55-64s recorded the highest real income growth, and their ability to draw down from their super further fuels consumption growth.

Growth in household consumption can be attributed to lifestyle changes:

- Stronger growth in their incomes, compared with other age groups.

- Household composition changes, such as children staying at home longer, or increased life expectancy.

Source: ABS, RBA Mar 2020 'Demographic Trends, Household Finances and Spending'

And while most Australians are struggling with the rising cost of living...

55-64s are the resilient super consumers

Less affected by the rising cost of groceries, interest rates, rental rates, and low wage growth

Source: Nine Consumer Pulse survey, March 2023

Report the lowest levels of financial distress (vs. other, younger age groups) and are significantly more likely to report that they have not experienced any financial distress in the last 12 months

Source: GfK Study April 2022

Feeling overall more positive than younger Australians

Source: Nine Consumer Pulse survey, March 2023

Spending habits

In the past 6 months, 45-64s have been spending on a wide range of categories from dining out and beauty to gardening and technology. They have also been spending more on all categories when compared to last year, with 49% having spent more on travel (domestic and overseas). And are spending more on key categories than their younger counterparts.

45-64s spending more when compared to last year vs average

Education

(Higher among 55-64s, x1.4)

Solar power

Experiences and entertainment

(Theatre, cinema, etc. – higher among 55-64s, x1.2)

Furniture

(Higher among 55-64, x1.3)

Technology

(Eg. smartphone, laptop, earphones – higher among 55-64s, x1.2)

Domestic travel/holidays

Source: GfK bespoke survey, April 2023

02

Despite their higher purchasing power, as consumers they are very similar to some of their younger counterparts

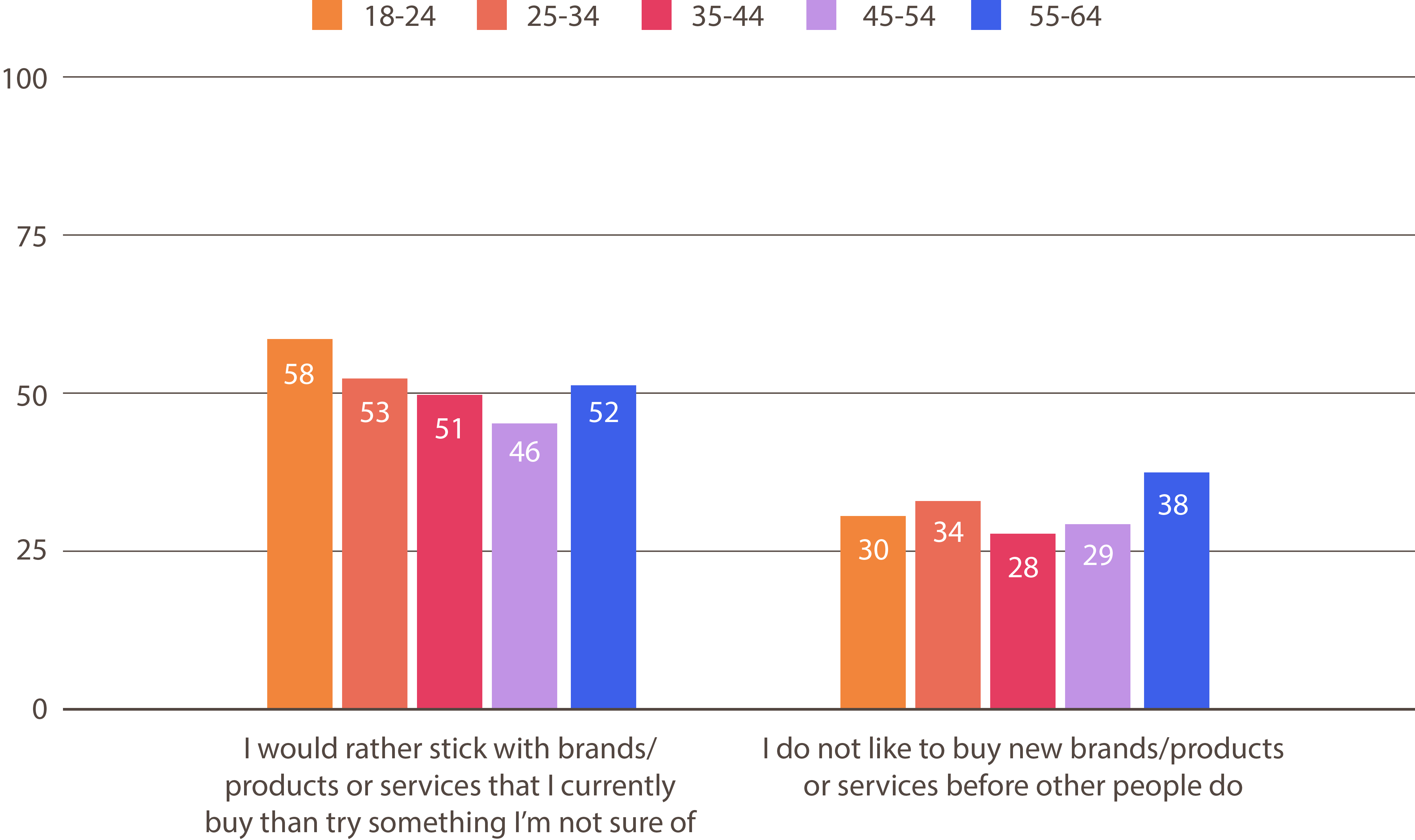

When it comes to brand loyalty, there are many generational similarities

Let us know how much you personally agree or disagree with each.

NET: Agree (%)

Source: GfK bespoke survey, April 2023

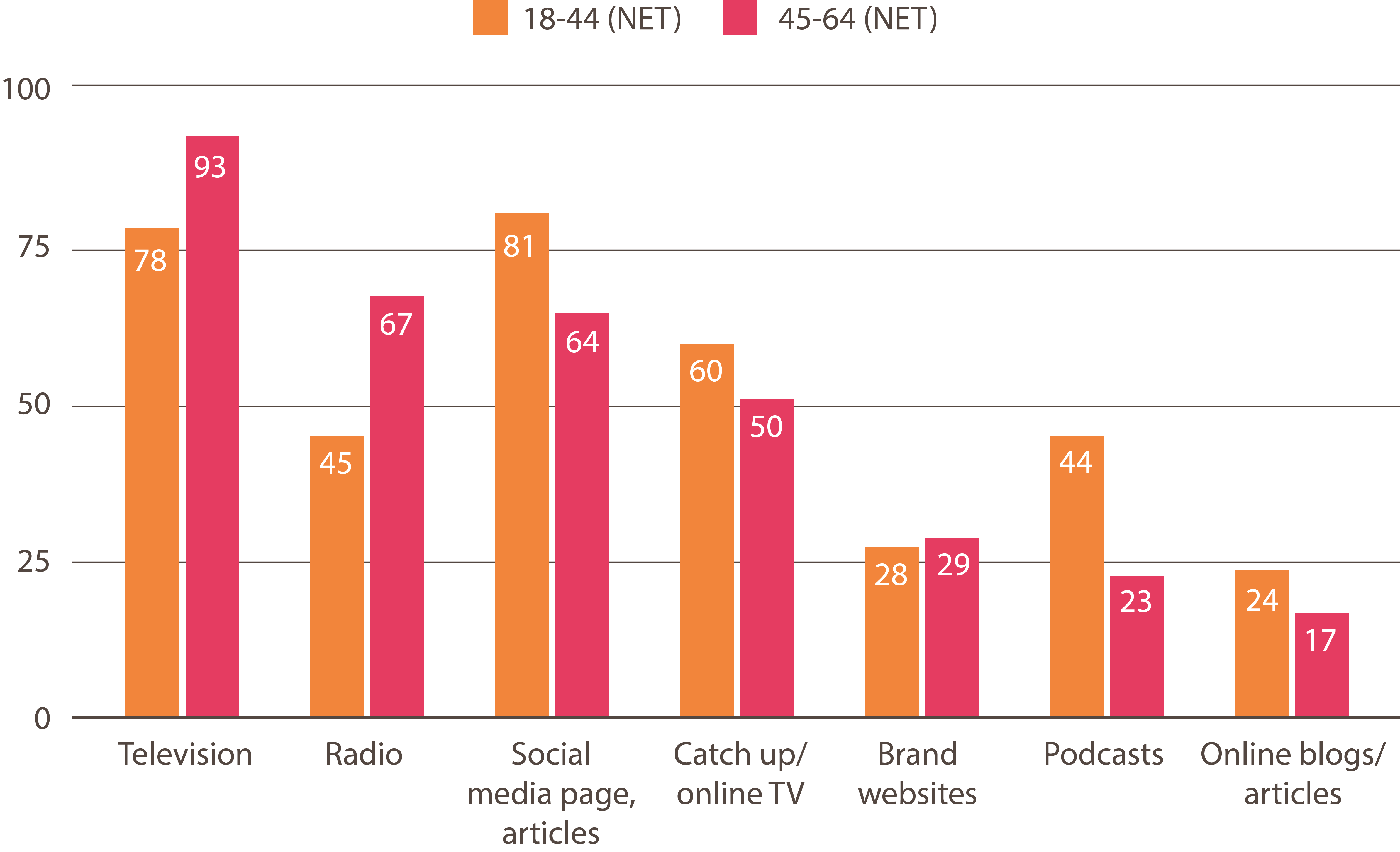

Their media consumption is spread across multiple platforms

In a typical week, which, if any of the follow do you read, watch or listen to? (%)

Source: GfK bespoke survey, April 2023

Personal values are relatively consistent across all age groups too

Honesty

Protecting the family

Authenticity

Freedom

Enjoying life

Stable personal relationships

Self-esteem

Friendship

Self-reliance

Working hard

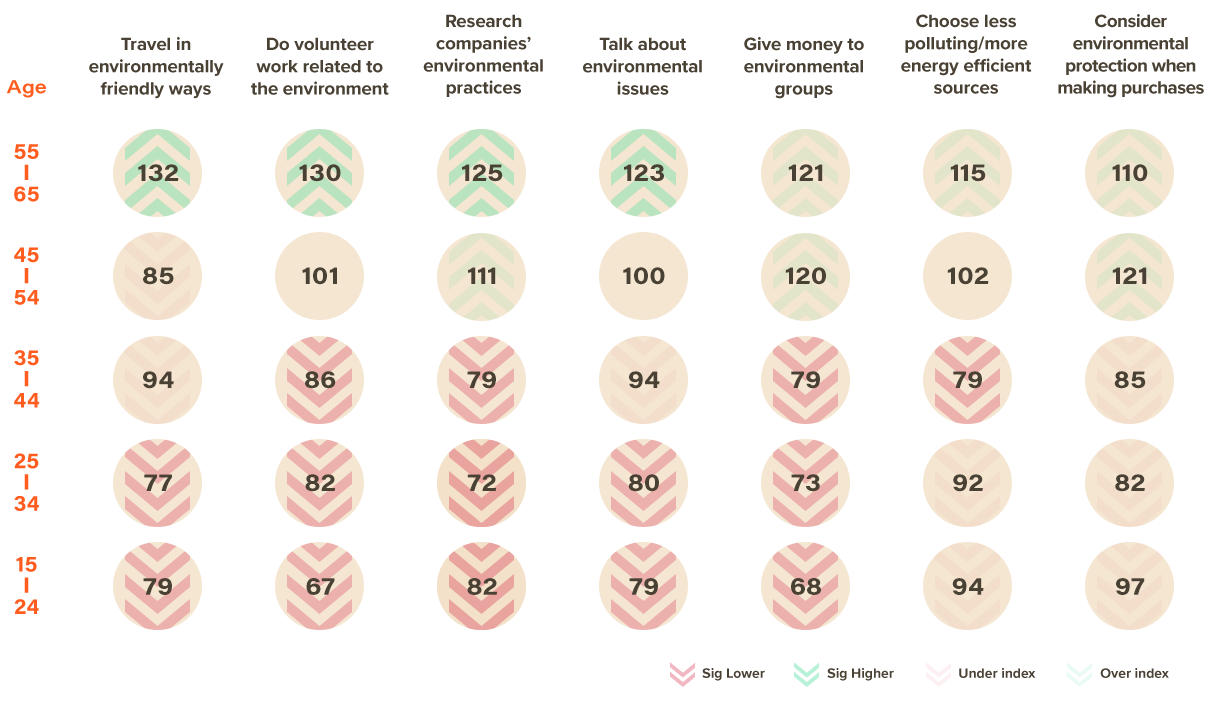

However, when it comes to being green, 45-54s and 55-64s stand out among younger cohorts

Source: GfK Consumer Life, April 2023

03

Super Consumers are influencers

"My mother bought a car. I recommended Toyota because of its reliability."

Male, 55-64

"Typically mobile phones and what is best for my parents."

Male, 55-64

"My dad has asked me if I knew anything about toasters so I described the toaster (I recently purchased) and where I purchased it from."

Female, 55-64

"I was asked by my parents what streaming products I recommend and I highly recommended Netflix as it is the best brand for streaming the latest movies."

Male, 45-54

Influencing generations before...

...and after them

"My daughter and her wife have just bought their first house. As part of setting up their new home, they have needed to buy new appliances and organise plumbers and electricians. My daughter has asked my opinion on both brands and contractors to help her make decisions on what to purchase and who from. I have been happy to help with that as I know she values my opinions gained from life experience."

Male, 55-64

"I have advised my adult daughters on recommendations for things like insurance, supermarket products like brands of tea and coffee to just name a couple...

Also, my experiences with my laptop brand and the store I bought it from."

Female, 55-64

"My daughter admired my coffee machine. I explained its features and what was needed for the average coffee buff. We discussed brands that she had been looking at in comparison to what I had."

Female, 45-54

"My son has wanted to purchase the same sort of fridge that I had just bought. So, I guided him on what to look for in a fridge and the companies/websites to look at or avoid."

Female, 55-64

Source: GfK bespoke survey, April 2023 qualitative interviews

And their influence is not limited to their immediate family

2 in 5

(45-64s)

told us they are involved in the purchase of brands/products for their family and friends

1 in 3

(45-64s)

said that they actively talk about experiences they have with brands, products or services

Source: GfK bespoke survey, April 2023

Super Consumers are...

Financially

resilient

Informed and engaged

Highly

influential

Now is the moment to re-think 'how we've always done it.'

For further information on the research, contact your Nine representative or complete the form. A member of the team will be in touch.