CONSUMER PULSE

We are living in uncertain times, but one thing is certain, the better we understand audiences, the better we can serve their needs and wants as marketers. In response to the COVID-19 crisis, Nine has launched a weekly consumer sentiment poll to understand how we can help brands connect with our audiences in 2020.

Nine. Where Australia Connects.

Methodology

Consumer Pulse is undertaken via short online surveys conducted weekly with Nine’s audiences - across linear television, 9Now and digital properties nine.com.au (and network sites), plus readers of news mastheads The Sydney Morning Herald, The Age and The Australian Financial Review (print + digital).

Capturing the mood

Week 2 - commencing 22nd March 2020

Headline Sentiments:

“Where are we on the curve?”

“When will we be fully locked down?”

“What will we do if I lose my job?”

“How & where do we get clear, concise information?”

“I’m concerned about others less fortunate than me”.

Macro themes

Seeking clarity

As developments continue to roll out about restrictions and job losses, consumers are considering the implications for their households in the short and medium term. They need clear information on where they stand, from government and businesses alike.

Brand implication

Opportunity to maintain positive brand presence by clearly communicating changes to services, availability of support or relief for customers.

Renewed perspective

The world is confronting increasing emotional challenges – isolation, loss of control, job insecurity and fear. Many consumers are starting to look for positives and deeper meaning – focusing on what’s important, redefining quality time, and exploring new meanings of community, solidarity and connection.

Brand implication

Opportunity for brands to enhance cultural relevance by becoming embedded in these emerging cultural trends and pivoting products, services and communications in response.

Looking outward

As Australians move beyond the initial responses of fear, dismissal and denial, their focus is broadening. As concerns about impacts for society, vulnerable groups and frontline workers are emerging, many are finding novel ways to show care and appreciation for others.

Brand implication

Brands should explore opportunities to support vulnerable groups, frontline workers and those employed in their sector. This has already started to emerge across the hospitality, retail and travel sectors.

With thanks to The Lab & Nature Research COVID-19 Brand Navigator.

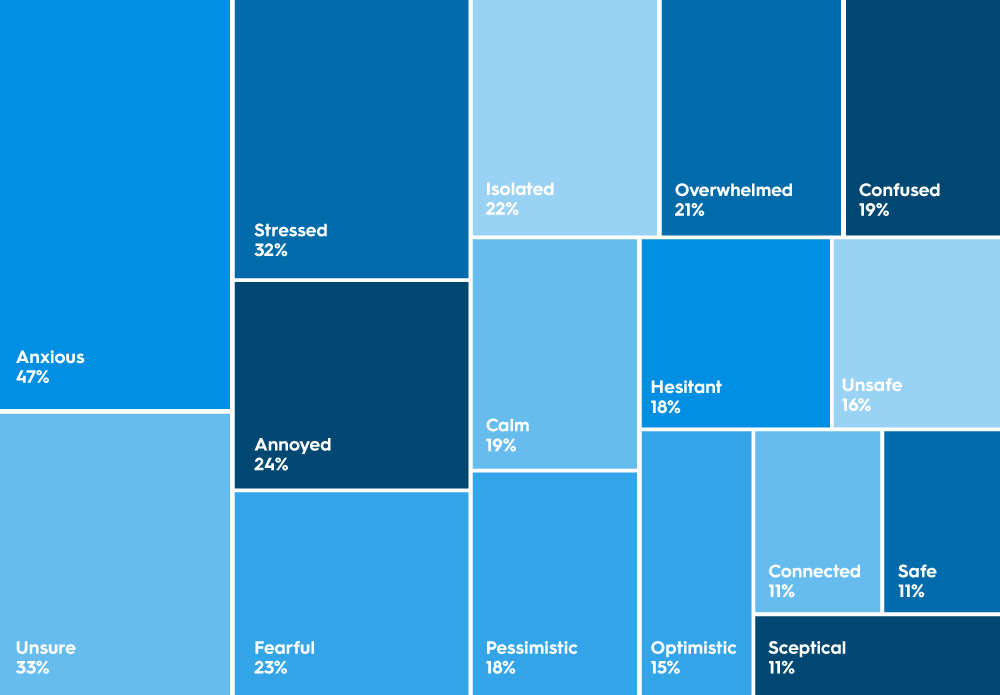

Mood tracker

News consumption

As we saw in the previous week, our audiences are spending a sizable amount of time accessing news. Results week-on-week suggest that overall our audiences are starting to become more selective about the sources they use – using fewer sources, being more selective and more reliant on trusted sources.

At the same time there is also an increasing appetite for good news and lighter news stories to balance out the COVID-19 coverage.

NOTE: For the best viewing experience on mobile, please view landscape.

Week-on-week changes

Audience concerns

Concern tracker

Concern about COVID-19 has risen across audiences, with sharpest increases among the Herald/ The Age (+21%) and 9Nation audiences (+10%).

Issues of greatest concern:

For audiences, the issues of greatest concern are shifting week-to-week. In our previous tracker audiences were primarily concerned with two issues: the impact of COVID-19 on family members (24% of 9Nation, 27% of the Herald / The Age audiences), and the impact on the economy (41% of Financial Review readers).

For all audiences, this has evolved into concern about the impact on broader society, communities, future wellbeing and how we’ll recover. Many have also become acutely concerned about the loss of employment and income.

Changes in issues of greatest concern

NOTE: For the best viewing experience on mobile, please view landscape.

Things audiences are doing more – changes in the last week

While our audiences continue adjusting to working from home, they are also relaxing more, watching more linear television and streaming services, and exploring digital services to connect with others. Online shopping is also increasing week-on-week, particularly among Financial Review readers.

NOTE: For the best viewing experience on mobile, please view landscape.

Impact on consumer spending

Spending on a range of categories increased on the previous week – with particular uplift among Financial Review readers across the board. Groceries, necessities, streaming services, news and home office supplies all rose. Expenditure on dining out, travel and fashion items saw declines.

NOTE: For the best viewing experience on mobile, please view landscape.

Marketing Messages

Audiences are particularly open to marketing messages focusing on utility and positivity. Many are interested in useful, practical and factual information to help navigate the challenges of COVID-19. Others are interested in positive news stories, socially responsible initiatives and reassurance. Financial Review readers are most likely to be looking for personalised information.

NOTE: For the best viewing experience on mobile, please view landscape.

Discover how Nine’s audience consumption has changed

From radio to television, our audiences are choosing trusted news and lifestyle brands to stay informed and entertained.

Take a closer look with our audience consumption report.